In specific situations, federal student loans can be forgiven, meaning you are not required to repay some or all of the loan. One of the common types of loan forgiveness is the Public Service Loan Forgiveness. The Public Service Loan Forgiveness Program provides loan forgiveness for people employed by the government or non-profit organizations. The second program is known as the Teacher Loan Forgiveness program. This provides loan forgiveness for teachers who have been working full time for five consecutive academic years in a low-paying elementary school, secondary school or educational agency.

Additionally, the Student Loan Forgiveness Program releases students from having to repay student loans in full or in part. Students pursuing post-secondary education often borrow loans to cater for their school fees. Loan forgiveness offers some crucial benefits. For instance, t stimulates the economy. People are struggling with many issues, including COVID-19 and paying student loans is becoming a big issue. Through loan forgiveness, money would be freed up for student loan borrowers. This money can then be spent in the economy. For instance, they could start a business or invest in other business ventures. This can be a great way to stimulate the economy and support economic relief activities like unemployment benefits.

Again, loan forgiveness helps in wiping out a certain amount of debt. When this amount is wiped out, some students may end up not paying any amount. Students who owe less debt can be forgiven from paying, which reduces the total number of borrowers in the country. Additionally, loan forgiveness can help students start their lives without student loans. Student loan debt contributes significantly to consumer debt. If borrowers could have their student loans forgiven, they can start life after graduating without the devastating impact of student loans. This can help them start saving for retirement early and have job mobility. Similarly, students with no loan have improved small business formation, increased family formation and marriage rates. This is because student loan forgiveness is considered a mental health problem. Students with high loans have anxiety and depression, which makes life harder for them.

It is also fundamental to note that loan forgiveness benefits regular people. Rich people often receive financial relief regularly. Through loan forgiveness, regular people can get the same financial relief making it easier for them to earn more income and enjoy more financial freedom. Additionally, loan forgiveness has greatly helped people of color. People of color are more burdened by student debt. Most of them end up defaulting because they cannot find jobs to help them pay these loans. This is what is making a lot of borrowers grow old without paying them. The pandemic has caused financial fallout for a lot of people who were already struggling to pay existing loans. Through loan forgiveness, most of these people would not have to worry about paying these debts anymore. Since college costs are increasing more than wages, loan forgiveness can be of great help to borrowers. They can start planning their future at a young age.

Advantages of Exceptional Company Services

Advantages of Exceptional Company Services Online Witchcraft Training Course

Online Witchcraft Training Course

Rent Houses Offer For Sale

Rent Houses Offer For Sale

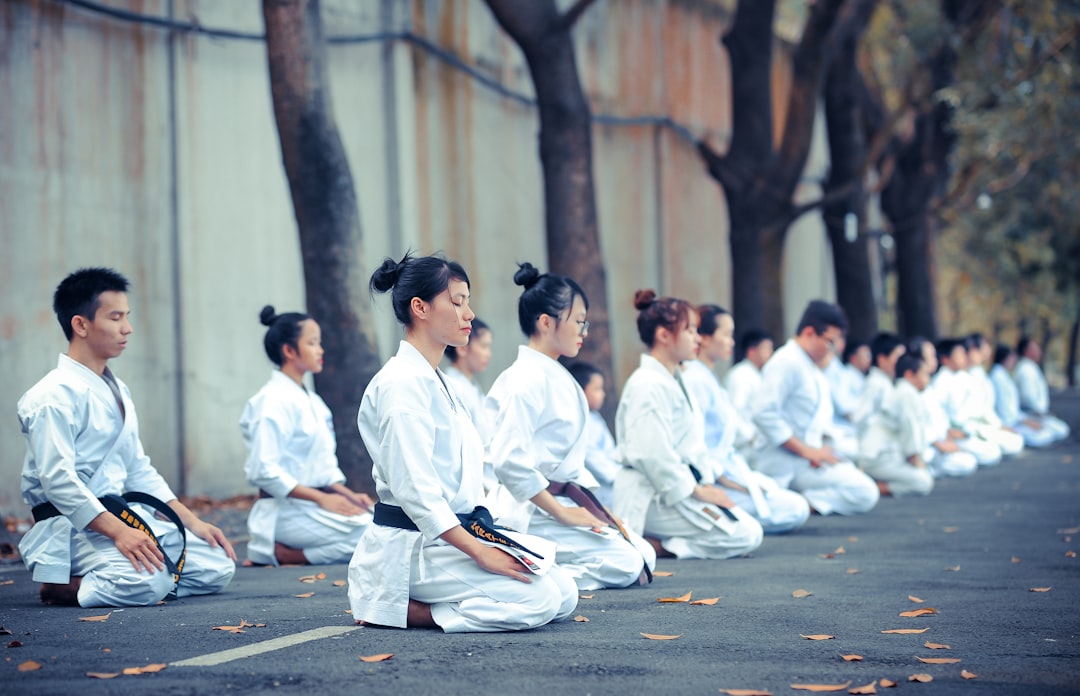

Martial Art Courses for the Youth

Martial Art Courses for the Youth